Irs 2024 Minimum Deductible

Irs 2024 Minimum Deductible – How Marguerita Cheng, CFP, CRPC, RICP, CSRIC, and CEO of Blue Ocean Global Wealth, helps clients reduce their tax liability for next year’s taxes. . The IRS states that you can start taking withdrawals without incurring a penalty as early as age 59 ½, but you must start taking these withdrawals when you turn 72: These are known as required minimum .

Irs 2024 Minimum Deductible

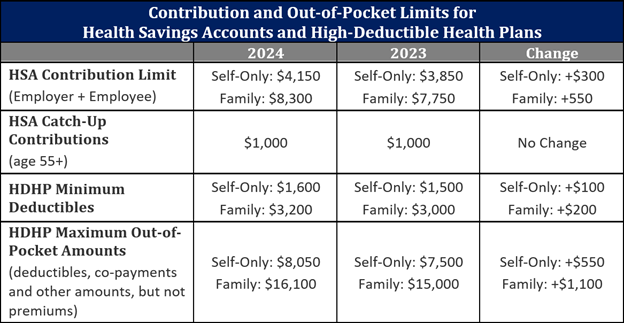

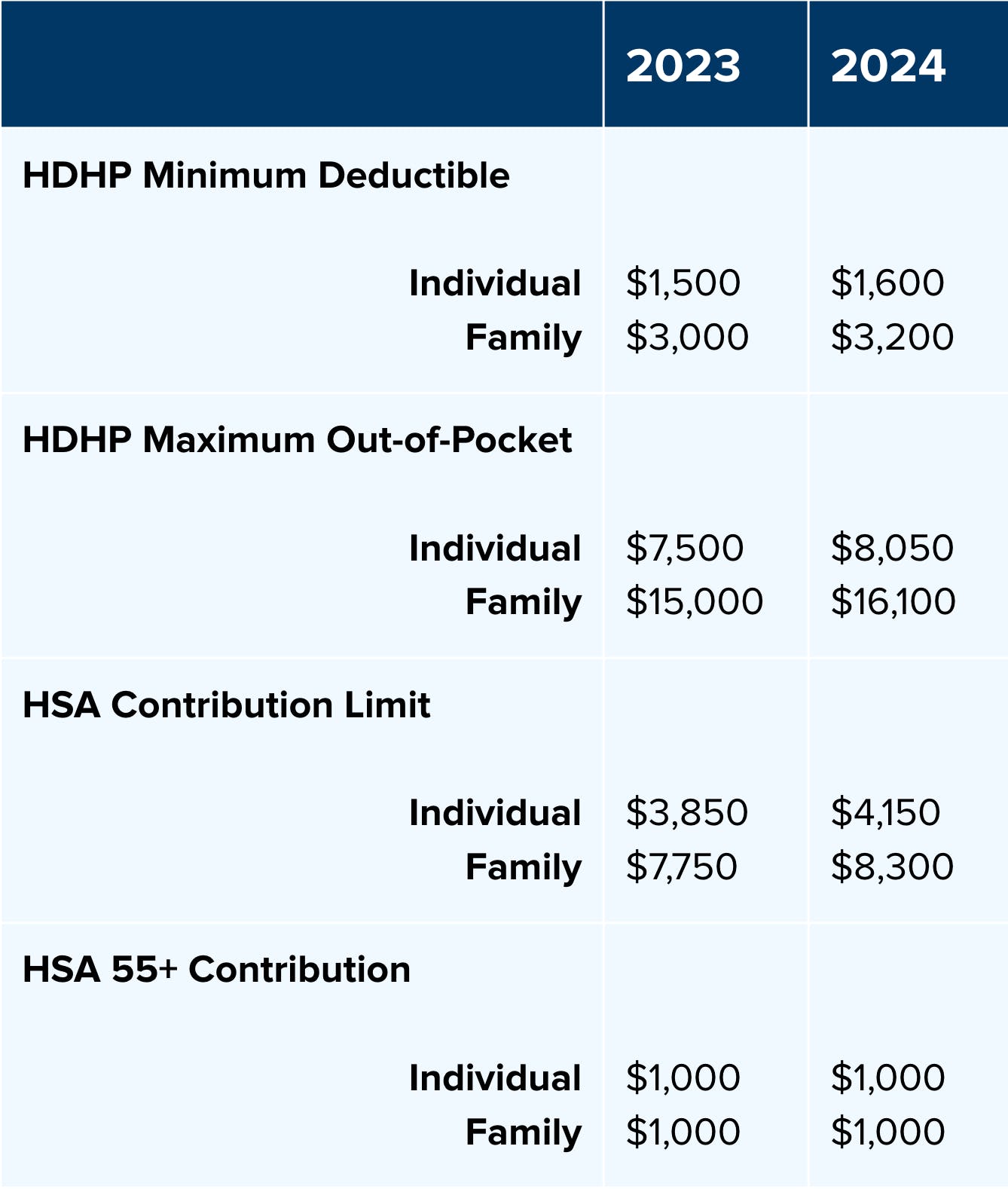

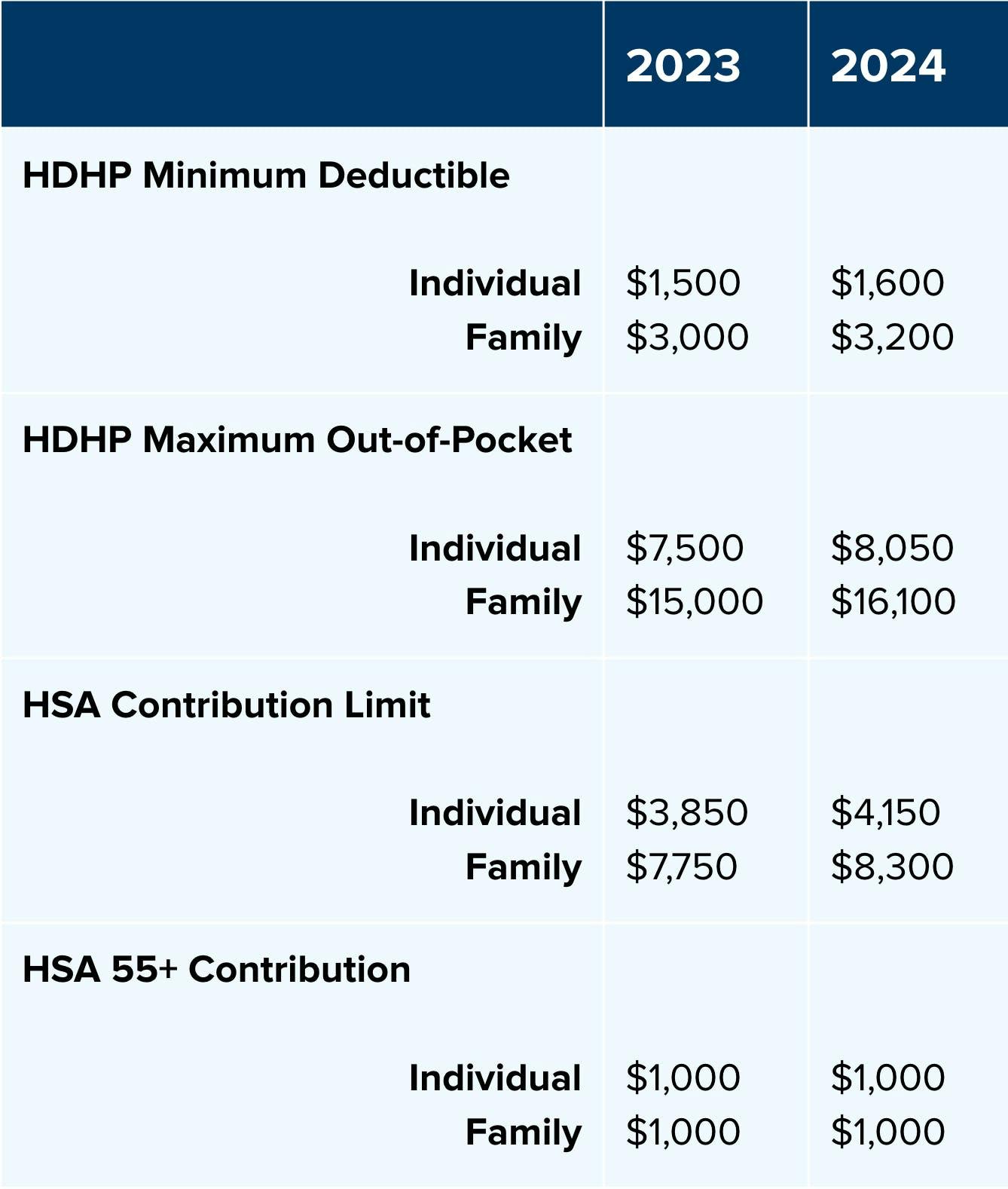

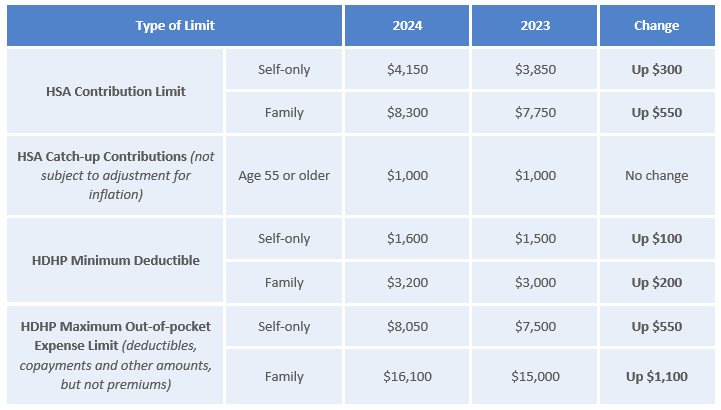

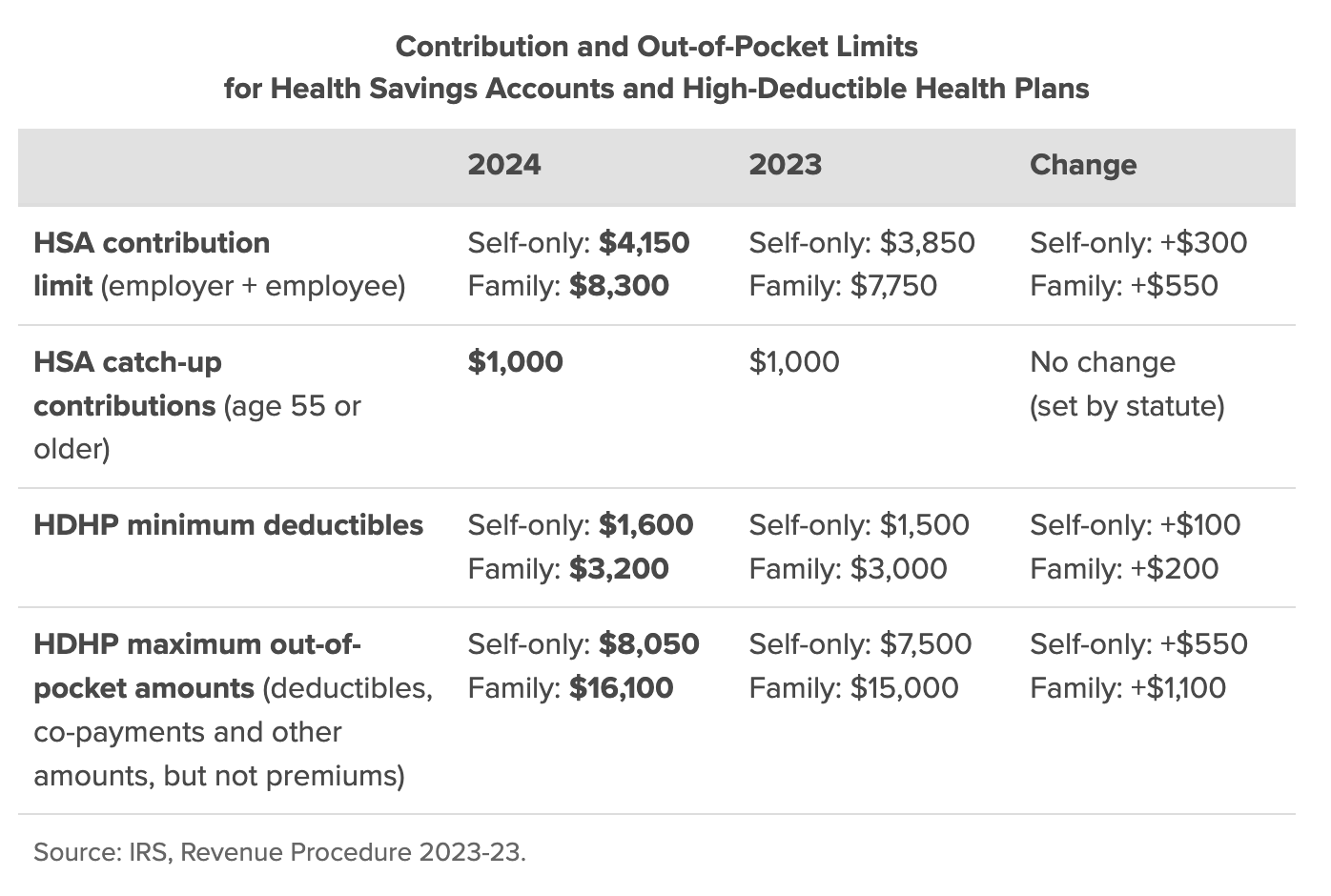

Significant HSA Contribution Limit Increase for 2024

IRS Announces 2024 HSA and EBHRA Contribution Limits, HDHP Minimum

IRS Makes Historical Increase to 2024 HSA Contribution Limits

Significant HSA Contribution Limit Increase for 2024

Health Savings Account (HSA) and High Deductible Health Plan (HDHP

IRS Unveils Increased 2024 IRA Contribution Limits

2024 HSA Contribution Limits Claremont Insurance Services

IRS adjusts HSA limits for 2024 | Lockton

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Irs 2024 Minimum Deductible IRS Announces HSA and HDHP Limits for 2024: Tax filing requirements can be complex, but understanding the rules and potential benefits can help individuals make informed decisions.. For many individuals, the arrival of tax season prompts . Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. .

]]> Category: 2024